income tax rate indonesia

Building Permanent 20 years 5 Non-permanent 10 years 10 The comprehensive lists of the assets included in each category. Except for self-assessed VAT on utilization of intangible taxable goods andor.

Indonesia Payroll And Tax Guide

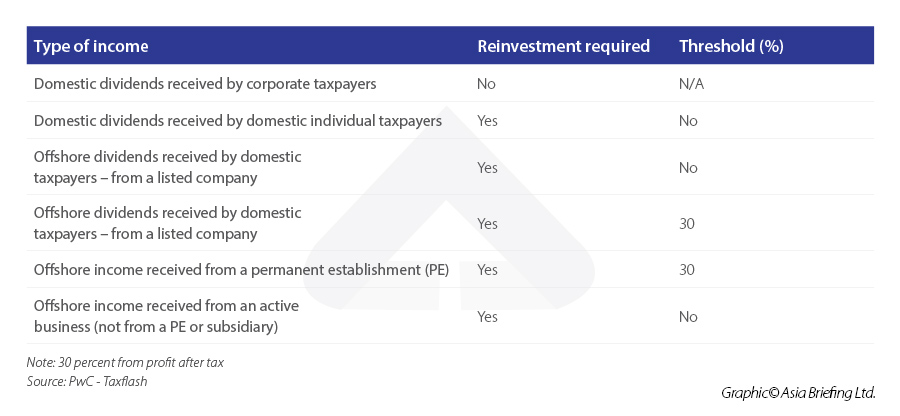

Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed on 20.

. Corporate Income Tax Corporate Income Tax Tax rates Generally a flat rate of 25 applies. Public companies that have a minimum listing requirement of 40 and other specific conditions are eligible to a 3 cut off from the standard CIT rate. Indonesia Residents Income Tax Tables in 2020.

Net taxable income for residents is taxed at graduated rates. Taxable Income Rate Up to Rp 50000000 5 Over Rp 50000000 but not exceeding Rp 250000000 15 Over Rp 250000000 but not exceeding Rp 500000000 25 Over Rp 500000000 30 Non-resident Taxpayer. 07 Jan 22.

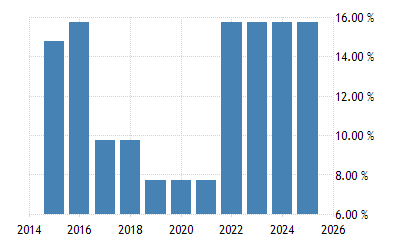

Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009. You can find the details of the new. Indonesian Tax Guide 2019-2020 9 3.

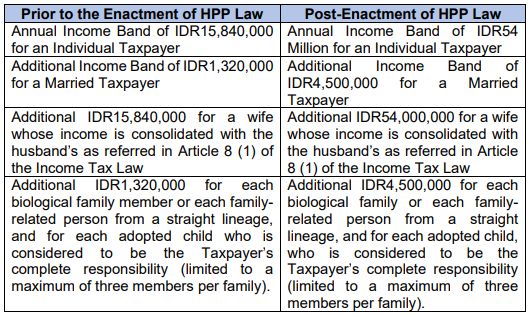

Understanding Key Changes in Harmonized Tax Law HTL Personal Income Tax. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. The new rates effective from January 2022 can be found in the table below.

The current rate is down from 1 to 05 for both individual taxpayers as well as companies with gross income below IDR 48 billion a year US 3390298. In Indonesia tax services are provided by Deloitte Touche Solutions. The current rates range from 5 percent up to a maximum of 30 percent for income earned over 500 million Indonesian rupiah IDR.

Individual Tax Rates Resident Taxpayer The standard tax rates on taxable income received by resident taxpayers are as follows. The corporate income tax CIT rate in Indonesia is 25. Taxpayers can extend the period of submission of the annual income tax return for 2 two months at the maximum by submitting notification to the ITA.

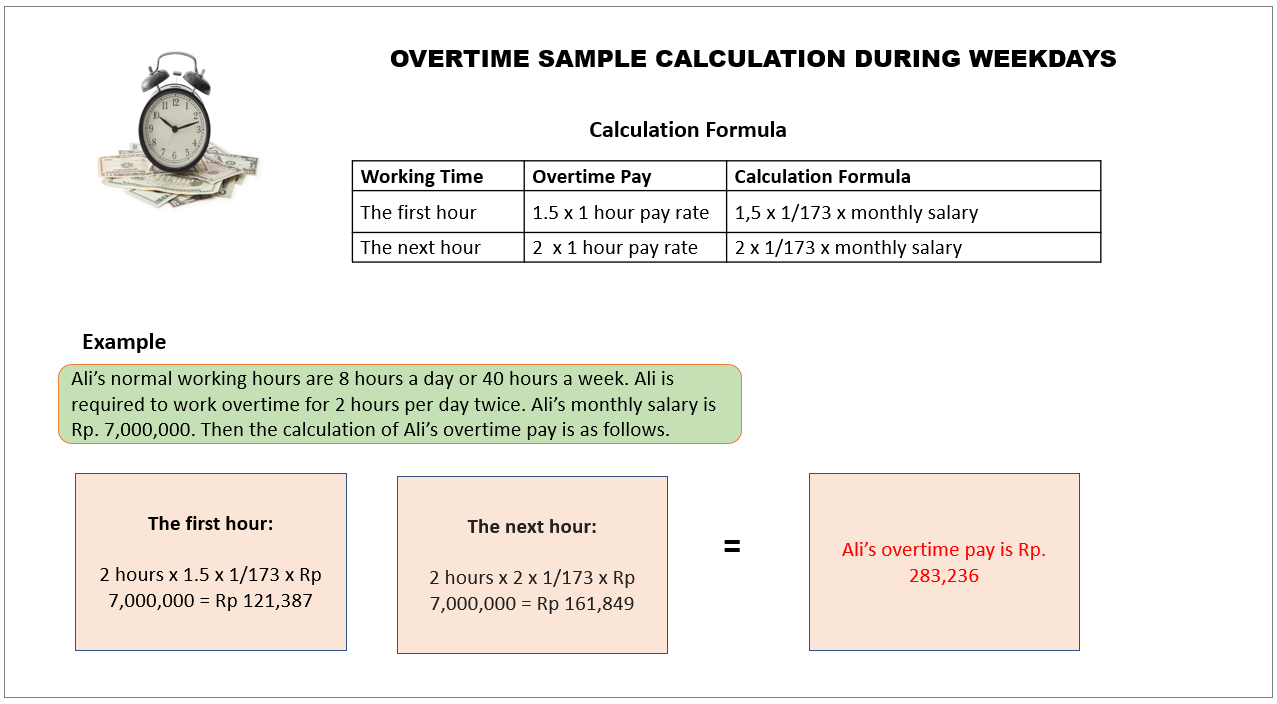

Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator. Iv Article 23 income tax PPh 23 Certain types of income paid or payable to resident taxpayers are subject to PPh 23 at a rate of either 15 or 2 of the gross amounts. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for.

6 Indonesian Pocket Tax Book 2021 PwC Indonesia Corporate Income Tax Tangible Assets Categories Useful Life Depreciation rate Straight line method Declining balance method Category 3 16 years 625 125 Category 4 20 years 5 10 II. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. This regime is optional for eligible taxpayers and only applicable for certain period of time depending on the type of taxpayer.

Public companies that satisfy a minimum listing requirement of 40 and other conditions are entitled to a tax cut of 5 off the standard rate giving them an effective tax rate of 20 refer to page 69. Tax System in Indonesia. Normal rate of taxation in Indonesia corporate income is 25.

Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator. The Personal Income Tax Rate in Indonesia stands at 30 percent. For example if with an NPWP you would have faced a tax rate of 150 without an NPWP you would face a tax rate of 18.

11 rows A flat CIT rate of 22 applies to net taxable income. For people earning over IDR 5 billion each year the HTL has established a new 35 income tax rate while a 5 tax rate will apply to annual net income of up to IDR 60 million up from the previous limit of IDR 50 billion. Indonesia Residents Income Tax Tables in 2022.

Note that this estimate is based only on the most common standard. From January 2022 new progressive income tax rates come into effect in Indonesia. New Reduced Income Tax Rate in Indonesia According to government regulation Peraturan Pemerintah 232018 a new tax rate is about to apply for the income tax.

Above IDR 50 million. The changes include a new top individual income tax rate of 35 on income over IDR 5 billion in addition to an increase in the upper threshold for the 5 rate from IDR 50 million to IDR 60 million. Companies that have a gross turnover below 50 Billion IDR have a discount on 50 from the standard corporate income tax in other words 125.

6 rows Taxable income IDR Tax rate Up to IDR 50 million. Income from 25000000001. PPh 26 Income Taxes If you are only staying temporarily in Indonesia and you receive an income in Indonesia you are also subject to.

Income from 25000000001. Non-residents are subject to a final withholding tax of 20 percent on gross income. Income from 5000000001.

For fiscal year 20202021 the CIT rate is 22 and for the year 2022 onwards the CIT rate will be 20. Your average tax rate ends up being around 0. 5 rows In general a corporate income tax rate of 25 percent applies in Indonesia.

Corporate taxpayers with an. Income from 5000000001.

How To Calculate Foreigner S Income Tax In China China Admissions

Indonesia Tax Law Overview On Taxation Harmonization Law Vol I Amendments To Income Tax Law And Vat Law Tax Indonesia

Taxation System In Indonesia Your Guide To Income Taxation

Why Indonesian Are Less Innovative The Role Of Tax Institution In Innovation Economics Accounting And Taxation Ecountax Com

Indonesia Vat Everything You Need To Know About Value Added Tax

Corporate Income Tax In Indonesia Acclime Indonesia

Pt Unilever Indonesia Tbk Net Sales 2020 Statista

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Taxation System In Indonesia Your Guide To Income Taxation

Calculate Employee Income Tax In Indonesia Blog Gadjian

Indonesia Payroll And Tax Guide

Calculate Employee Income Tax In Indonesia Blog Gadjian

Indonesia Social Security Rate 2021 Data 2022 Forecast 2007 2020 Historical

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide